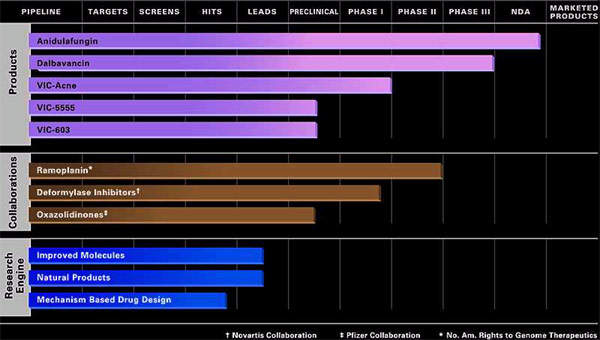

Originally developed by Vicuron Pharmaceuticals (which was subsequently acquired by Pfizer and then Durata Therapeutics), dalbavancin is a novel second-generation glycopeptide indicated for the treatment of serious gram-positive bacterial infections in hospitalised patients.

In December 2004, the company filed a new drug application with the US Food and Drug Administration (FDA) for use of dalbavancin in the treatment of complicated skin and soft tissue infections.

The application was supported by data on more than 1,850 subjects enrolled in three phase III trials, which evaluated the safety and efficacy of dalbavancin in patients with complicated skin and soft tissue infections.

At the end of 2007, Pfizer received an approvable letter from the FDA for the use of dalbavancin as a treatment for adult patients with complicated skin and soft tissue infections, including those caused by MRSA. The FDA was expected to grant marketing approval when it receives requisite additional data from Pfizer.

Pfizer also submitted marketing authorisation application to European authorities in 2008, but it was later withdrawn so that additional clinical trials could be conducted.

In September 2008, Pfizer announced that it would withdraw all dalbavancin marketing applications globally to allow it to conduct additional Phase III clinical trials. The decision was based on the feedback from regulatory authorities and was aimed to support regulatory submissions planned for future.

In December 2009, start-up venture Durata Therapeutics acquired Vicuron Pharmaceuticals from Pfizer. Durata now owns dalbavancin, and initiated a new Phase III trial in April 2011. The company will take development of dalbavancin into approval although it is yet to decide on whether to commercialise the drug on its own.

Pfizer has retained rights to Vicuron’s other antifungal agent, anidulafungin.

Advances in glycopeptide antibiotic development

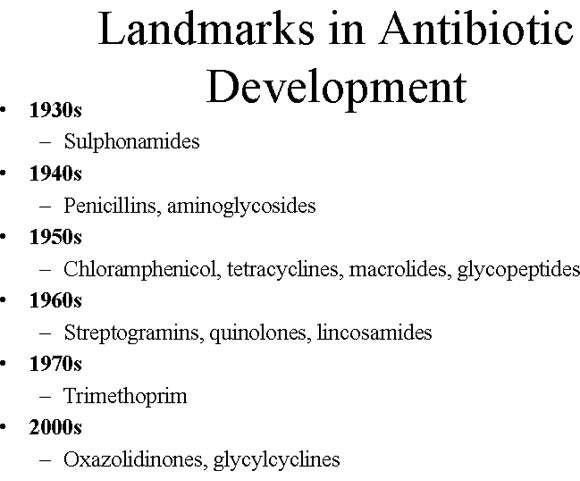

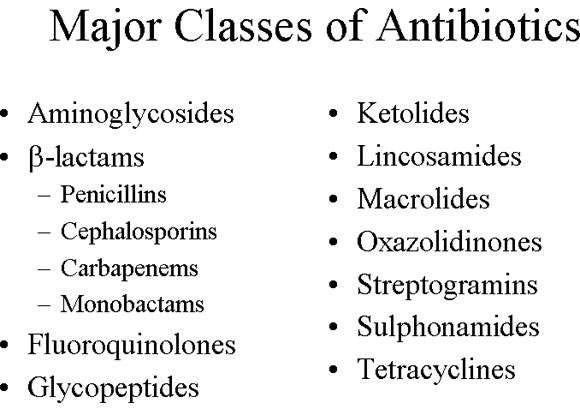

Dalbavancin is a member of the glycopeptide class of antibiotics, to which vancomycin and teicoplanin also belong. They are an important class of antibiotics for treating serious gram-positive infections, including those caused by staphylococci and enterococci.

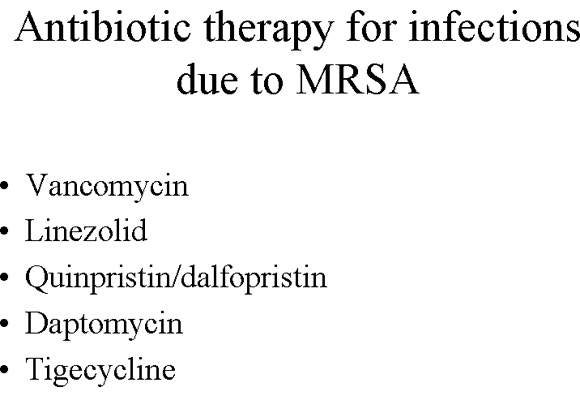

Vancomycin has been the mainstay of difficult-to-treat infections such as MRSA. Recently, evidence has emerged to suggest that some strains of Staphylococcus aureus are becoming less susceptible to vancomycin, while more strains of enterococci are becoming fully resistant.

Dalbavancin has been specifically developed as an improved alternative to vancomycin, with potentially enhanced in vitro potency, including bactericidal activity, against gram-positive pathogens.

Its enhanced potency and long half-life enable it to be administered intravenously just once per week, as opposed to vancomycin, which typically involves multiple daily infusions. This simpler dosing regimen may reduce the need for the continued presence of IV lines in some patients, and could potentially reduce local and bloodstream infections.

Dalbavancin has a favourable pharmacokinetic profile since the drug is not a substrate, inducer or inhibitor of cytochrome P450 enzymes and there is no need to monitor drug levels.

Evidence for efficacy in pivotal Phase III trials

Dalbavancin has shown solid evidence of efficacy in three Phase III studies in patients with complicated skin and soft tissue infections and in a Phase II study in catheter-related bloodstream infections (CR-BSI), where it proved superior to vancomycin.

In the randomised, open-label Phase II clinical trial, 67 patients with CR-BSI caused by suspected or documented gram-positive pathogens were treated with either two doses of dalbavancin one week apart or vancomycin twice daily for 14 days.

The primary endpoint was a composite of clinical and microbiological responses 21 days after the end of treatment; 87% (20 out of 23) of dalbavancin-treated patients responded to therapy compared with 50% (14 out of 28) of those treated twice daily with vancomycin.

In the Phase III clinical trials, dalbavancin met the primary and secondary endpoints of non-inferiority in comparison with linezolid, cefazolin or vancomycin; three commonly used standard-of-care antibiotics for complicated skin and soft tissue infections.

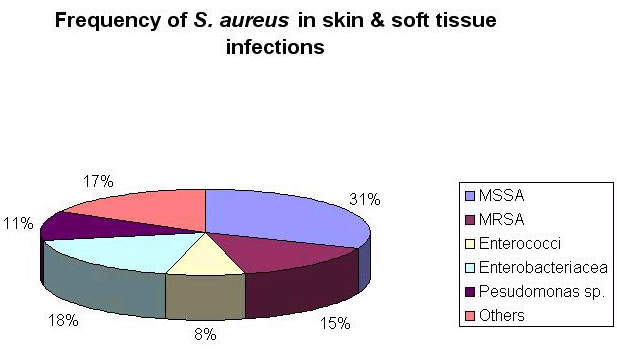

The vast majority of the patients treated in these studies had infections caused by Staphylococcus aureus, with more than 400 patients infected with MRSA.

In April 2011, Durata initiated a randomised, double-blind, double-dummy phase III clinical trial, knwn as DISCOVER-1. The study is being conducted under a special protocol assessment agreed with the FDA and is scheduled to be completed by September 2012. It will enrol 556 patients with acute bacterial skin and skin structure infections.

The study will compare the efficacy and safety of dalbavancin with vancomycin and linezolid. The primary outcome measure of the study will be to find the early efficacy of the drug after 48-72 hours of therapy.

Marketing commentary

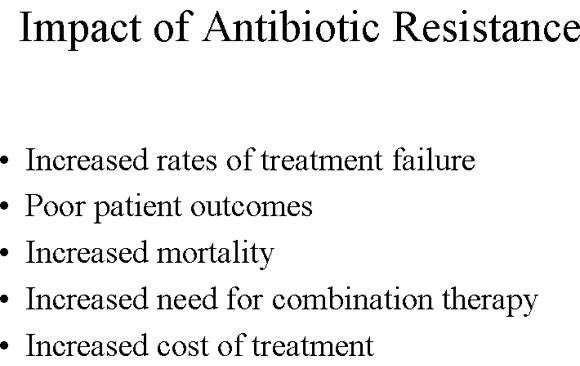

In an era of rising rates of bacterial resistance to commonly used antibiotics, new agents are urgently needed to treat bacterial infections effectively and halt the spread of resistant strains.

This need is arguably greatest in the hospital environment where rates of bacterial resistance are highest. MRSA is a particular problem because it displays resistance to most classes of antibiotics.

Although the hospital antibacterial market represents only a third of all antibacterial sales, increasing antibiotic resistance in the hospital environment has increased the demand for more effective antibiotics making it an attractive sector for new antibacterial agents. As a potential successor to vancomycin, dalbavancin appears well placed to succeed.